Banking 101: What to Do With a Substitute Check

What is a Substitute Check?

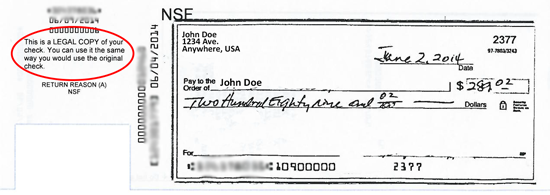

A substitute check is an official image and the legal equivalent of a paper check (original) as long as it includes the following statement:

“This is a legal copy of your check. You can use it the same way you would use the original check”.

What Can You Do with a Substitute Check?

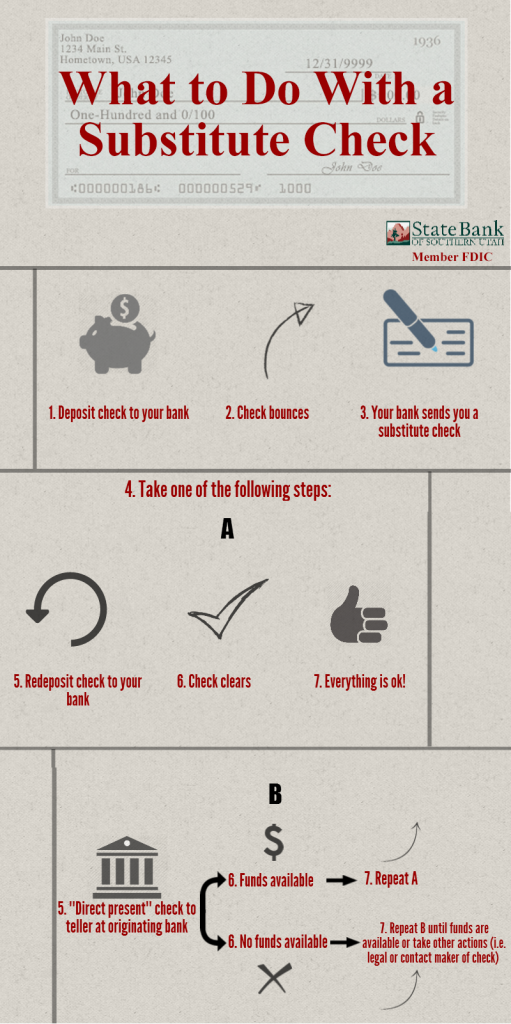

A substitute check allows you to do anything you can do with the original. You may:

- Redeposit it,

- Pursue legal action with it, or

- Ask the maker to exchange it for good funds

If you receive a substitute check that has failed to clear an account twice (in any combination of original or substitute), the law says you cannot redeposit the check again. You must pursue other avenues of recourse at this point.

You can take the substitute check to the bank upon which it is drawn and simply present the substitute check to a teller and ask if there are enough funds for the check to clear. This is often called “direct presenting” the check . You can do this as often as you wish. Moreover, some banks provide a collection service (contact the bank upon which the check is drawn).

What if You Find Posting Errors Caused by a Substitute Check?

You may request a refund for losses that you suffer if a substitute check incorrectly posts to your account.

For example:

- Wrong amount posted to the account

- Same check posted twice

- Check posted to the wrong account

The amount of your refund is equal to the amount of your loss or the amount of the substitute check that you received, whichever is less.

The Customer’s Responsibility

If you have received a substitute check and State Bank made an error directly related to it, the regulations give you 40 calendar days to report the problem. This window is longer than the usual reporting window of 30 days for original checks. To be safe, report all errors within 30 days to shift liability for the error to your bank. You’ll be covered regardless of the transaction type. Note: A copy of a check or a statement with check images is not a substitute check.

Steps to Make a Claim for a Refund

- Provide a description of why you have suffered a loss (for example, you think that we paid a check twice)

- Provide the amount of your loss or best estimate

- Provide a copy of the substitute check or the following information to help us identify it:

- Check Number

- Payee (person who wrote the check)

- Amount

- Date check was written

- Once you have the above information please contact State Bank:

- State Bank of Southern Utah

Attn: Bookkeeping

377 North Main

Cedar City, UT 84720

- Phone – (435) 586-2340

- Fax – (435) 586-2380

State Bank’s Responsibility

State Bank gets time to research your claim. If State Bank finds that your claim is valid, you will be refunded the next business day. If the bank cannot figure out what happened within 10 days, you will be credited up to $2,500 (plus interest if your account earns interest). The bank gets 45 days for amounts over $2,500. Any money credited to your account, may be reclaimed if the bank later determines that there was no error.

About Us

Hometown banking was established in southern Utah with the opening of State Bank of Southern Utah in 1957.

Hometown banking is important because people who live and work in southern Utah make the decisions. Bank employees and officers understand the banking needs of area residents because they are affected by the same economic climate. Find out what hundreds already know - hometown banking is better.

Archives

- June 2015

- May 2015

- January 2015

- December 2014

- October 2014

- September 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012